Researchers at Bird & Co have explored this recently released data to present a detailed overview of the housing market trends throughout 2023. The study not only highlights areas with significant house price changes, but also delves into broader economic impacts for homeowners and potential buyers.

The analysis of Land Registry data from January to December 2023 shows South Hams had the second highest percentage house price increase, just under Scotland’s Na h-Eileanan Siar.

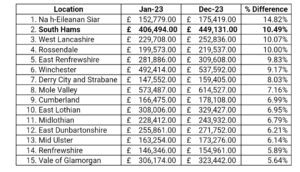

The 15 locations that saw the biggest rise in house prices were:

Situated in Devon, South Hams saw the second largest increase in house prices throughout the whole of the UK, with the average house price increasing by 10.49%. South Hams properties have increased significantly, especially in comparison to neighbouring areas such as City of Plymouth, which saw a decrease of 2.72% in average property prices from January to December.

A detached home in South Hams saw a significant rise from £610,266 in January ‘23 to £672,979 in December ‘23, boasting a 10.28% increase. A semi-detached increased by 13.16%, a terrace house increased by 9.85%, and the average price of a flat increased by 8.64%.

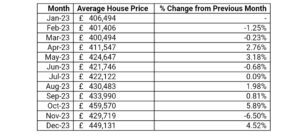

The average house prices in South Hams fluctuated up and down throughout the year, peaking in October. The average house prices, as well as the percentage increase for South Hams, month to month were as follows:

In contrast to areas listed in the top 15, house prices dropped hardest in some of the most expensive boroughs, including City of Westminster, Kensington and Chelsea, and Hammersmith and Fulham.

Daniel Chard, Partner at Bird & Co, says “Interestingly, the areas that show the largest increase in house prices vary between England, Wales, and Scotland, showing a range of factors are at play; not just location.

“The figures suggest that there has been an increase in demand for houses in these areas, representing economic stability and growth, potentially low unemployment rates, and affordable housing.

“For aspiring homeowners, the housing market’s status dictates affordability and accessibility. Rising prices pose challenges, demanding higher down payments and limiting options. On the other hand, stability or decreases create a more favourable environment for those entering the market.

“Sudden changes trigger cascading effects, shaping lending practices, construction trends, and consumer confidence. Staying informed is crucial for informed decisions in the dynamic housing market.”

If you are looking to buy a property in South Hams in 2024 and require a solicitor to get you started, Bird & Co can help. If you are planning to purchase, sell or remortgage your home, then get in touch with Bird & Co’s South Hams conveyancing solicitors by emailing enquiries@birdandco.co.uk.

You can join us on our social media pages, follow us on Facebook, X (formerly known as Twitter) and Threads where you can keep up to date with whats going on in South Devon.

Got a news story, blog or press release that you’d like to share or want to advertise with us? Get in touch via email admin@wearesouthdevon.com